The Venture Capital Landscape for Immersive Entertainment

The Future Outlook for Immersive Entertainment Investments

Investment Opportunities in Virtual Reality (VR) Experiences

The burgeoning VR market presents significant investment opportunities, particularly in areas like social VR, educational VR, and VR gaming. Investors must evaluate the potential of specific VR applications carefully. Understanding user demographics, technological advancements, and competitive landscapes is crucial for successful investment decisions. Early-stage VR companies often require substantial funding to develop and market innovative experiences, making venture capital funding vital for their growth.

VR headsets are becoming increasingly affordable and accessible, driving user adoption. This increased user base creates a larger potential market for developers and content creators, making VR a potentially lucrative investment area.

Augmented Reality (AR) Applications for Businesses

Augmented reality (AR) is revolutionizing various industries, offering innovative solutions for training, design, and customer engagement. Businesses across sectors can leverage AR to enhance productivity and improve decision-making. Investment in AR development tools and platforms could yield substantial returns as businesses adopt these technologies for practical applications.

AR applications are rapidly evolving, creating new investment opportunities in areas like AR-powered design tools, interactive product demonstrations, and personalized customer experiences.

The Metaverse's Potential for Transformative Experiences

The metaverse, a virtual world with interconnected virtual spaces, presents a vast and complex investment landscape. Early investments in metaverse platforms, virtual real estate, and digital assets could yield significant returns as the technology matures and adoption increases. However, challenges remain, including the need for robust infrastructure, user adoption, and regulatory frameworks.

The metaverse holds the potential to revolutionize how we interact, work, and play. Investing in foundational technologies and platforms of the metaverse could be highly rewarding, but investors must be prepared for the long-term nature and inherent risks of nascent markets.

The Role of Blockchain in Securing Digital Assets

Blockchain technology is increasingly integrated into immersive entertainment, offering a secure and transparent way to manage digital assets and intellectual property. Investors can explore opportunities in blockchain-based platforms for virtual goods, in-game items, and digital collectibles. This integration will likely be crucial for establishing trust and value within immersive virtual environments.

The Importance of Content Creation for Immersive Experiences

High-quality content is paramount for immersive entertainment success. Investment in talented developers, artists, and storytellers is essential to create compelling and engaging content that attracts and retains users. The creation of immersive narratives, interactive experiences, and innovative game mechanics will drive user engagement and market penetration.

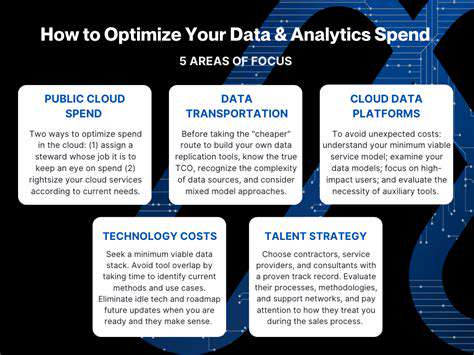

Funding Strategies for Emerging Immersive Entertainment Startups

Securing funding for immersive entertainment startups often requires a strategic approach, combining traditional venture capital with specialized funding mechanisms. Understanding startup needs, such as innovative technology development, content creation, and user acquisition, is crucial for investors. A strong market understanding and technology potential assessment will be key to a successful investment strategy.

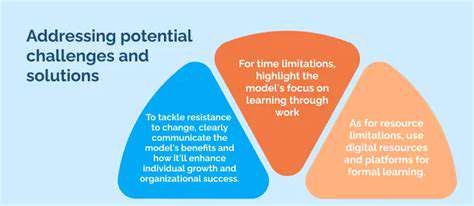

The Need for Regulatory Frameworks and User Privacy

Addressing privacy and security concerns in immersive entertainment is essential. Investment in solutions protecting user data and ensuring responsible technology use is crucial for sustainable growth. Establishing clear regulatory frameworks for virtual worlds and digital interactions will create a trusted and safe user environment. Understanding the legal and ethical implications of immersive technologies is paramount for investors and developers.

Read more about The Venture Capital Landscape for Immersive Entertainment

Hot Recommendations

- Immersive Culinary Arts: Exploring Digital Flavors

- The Business of Fan Funded Projects in Entertainment

- Real Time AI Powered Dialogue Generation in Games

- Legal Challenges in User Generated Content Disclaimers

- Fan Fiction to Screenplays: User Driven Adaptation

- The Evolution of User Driven Media into Global Entertainment

- The Ethics of AI in Copyright Protection

- Building Immersive Narratives for Corporate Training

- The Impact of AI on Music Discovery Platforms

- AI for Audience Analytics and Personalized Content