The Role of Smart Contracts in User Driven Media Royalties

Understanding the Fundamentals of Smart Contracts

Smart contracts represent a groundbreaking shift in contractual agreements, embedding terms directly into executable code rather than relying on paper-based documentation. Unlike conventional contracts that depend on third-party enforcement through legal systems, these digital contracts self-execute on blockchain networks. By removing intermediaries, businesses can slash operational costs and accelerate processes that once took weeks into mere minutes. The immutable nature of blockchain ensures every transaction remains transparent and tamper-proof, creating unprecedented levels of trust between contracting parties.

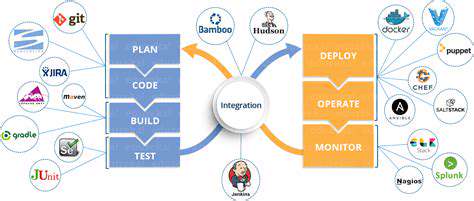

The architecture of smart contracts revolves around conditional programming logic deployed across decentralized ledgers. When predetermined triggers occur - whether payment confirmations, shipment arrivals, or performance milestones - the code automatically enforces the agreed terms. This distributed verification mechanism eliminates single points of failure, making contractual fraud exponentially more difficult compared to traditional systems. Such robustness explains why industries from finance to real estate are racing to adopt this technology.

Implementing Smart Contracts in Various Industries

Supply chains stand to gain tremendously from smart contract integration. Consider luxury goods manufacturers using blockchain to authenticate products at every distribution point. Automated verification tokens embedded in smart contracts can instantly confirm an item's origin and journey, effectively neutralizing counterfeit markets that cost brands billions annually. Shipping logistics also benefit through real-time tracking updates that trigger payments upon delivery confirmation, eliminating invoice disputes.

Financial institutions are leveraging this technology to revolutionize payment systems. Loan agreements now execute automatically when borrowers meet collateral requirements, with blockchain records providing indisputable audit trails. The rise of decentralized finance (DeFi) platforms demonstrates this potential, where algorithmic smart contracts enable peer-to-peer lending at scales traditional banks can't match. Transaction settlements that previously required three banking days now complete in under three minutes.

Property markets experience similar transformation through automated title transfers. Smart contracts linked to land registries can execute ownership changes the moment purchase conditions are fulfilled, bypassing notary delays. Escrow services become obsolete when funds automatically release to sellers upon successful property handover. This efficiency extends to rental agreements, where smart locks activated by blockchain payments create seamless tenant experiences.

The healthcare sector applies this technology for secure patient data sharing between authorized providers. Clinical trial agreements automatically compensate participants when study milestones are verifiably achieved. Even democratic processes benefit, with blockchain-based voting systems ensuring ballot immutability while smart contracts tally results without human intervention.

Evaluating marketing effectiveness requires focusing on indicators that directly impact organizational objectives. Vanity metrics often distract from meaningful performance analysis - the key lies in identifying which data points align with strategic goals. When comparing engagement, a 15-second average watch time on video ads outperforms 5-second views, regardless of total impression counts. Longitudinal analysis of these behavioral metrics reveals audience preferences that static reports might overlook.

The Future of User-Driven Media Royalties

The Rise of Decentralized Platforms

Blockchain-based content platforms disrupt traditional media models by transferring economic control directly to creators. These distributed networks use cryptographic verification to ensure creators receive fair compensation, often through microtransactions impossible in legacy systems. A musician might earn cryptocurrency fractions each time their song streams, with smart contracts bypassing record label profit-taking.

Smart Contracts: Automating Royalties

The royalty distribution process achieves new efficiency through programmable agreements. When a digital artwork sells on blockchain marketplaces, pre-coded smart contracts instantly split proceeds between the artist, platform, and any collaborators according to predetermined percentages. This automation extends to residual payments - photographers earn whenever their images get reused, with blockchain tracking every subsequent publication.

Enhancing User Experience and Engagement

Content platforms implementing this technology see increased creator retention through transparent earnings dashboards. Fans can directly support creators through blockchain tipping features, with smart contracts ensuring instant fund transfers. Gamified reward systems incentivize quality content, where upvotes translate to verifiable cryptocurrency bonuses distributed automatically.

Challenges and Considerations

Scalability remains an obstacle, with some blockchains struggling under high transaction volumes required for mass adoption. Regulatory uncertainty around cryptocurrency taxation creates compliance challenges for creators. Platform developers must prioritize intuitive interfaces to overcome the technical barriers preventing mainstream creator adoption.

The Future of Content Creation

This technological convergence points toward an internet where users own their digital footprints. Social media platforms may evolve into cooperatives governed by creator communities rather than corporate shareholders. As blockchain identity solutions mature, we'll see reputation systems where quality content earns verifiable credentials that unlock monetization opportunities across platforms.

Read more about The Role of Smart Contracts in User Driven Media Royalties

Hot Recommendations

- Immersive Culinary Arts: Exploring Digital Flavors

- The Business of Fan Funded Projects in Entertainment

- Real Time AI Powered Dialogue Generation in Games

- Legal Challenges in User Generated Content Disclaimers

- Fan Fiction to Screenplays: User Driven Adaptation

- The Evolution of User Driven Media into Global Entertainment

- The Ethics of AI in Copyright Protection

- Building Immersive Narratives for Corporate Training

- The Impact of AI on Music Discovery Platforms

- AI for Audience Analytics and Personalized Content