The Economy of the Metaverse: NFTs, Virtual Goods, and More

Virtual Goods: A New Economic Frontier

From in-game weapons to digital avatars, virtual goods are transforming how we perceive value in the digital age. These assets, though intangible, command real-world prices in online marketplaces, creating lucrative opportunities for both corporations and individual creators. The rapid evolution of this sector introduces novel economic models and marketplaces, reshaping traditional commerce. Their valuation hinges on scarcity, utility, and cultural relevance within digital ecosystems.

What makes virtual goods fascinating is their volatility. Prices shift based on player engagement, platform updates, and broader trends in digital culture. This creates exciting prospects for investors but demands thorough analysis to navigate successfully. The speculative nature of these markets requires participants to stay informed about platform policies and community trends.

The Rise of Virtual Services

Parallel to digital goods, service-based offerings are flourishing in virtual spaces. Online education, digital consultations, and immersive experiences represent just the beginning. These platforms enable professionals to expand their reach globally while providing consumers with unprecedented access to specialized knowledge and experiences.

Several factors drive this growth: the normalization of remote collaboration, increasing demand for flexible education models, and society's growing comfort with digital interactions. Together, they create fertile ground for service innovation across industries.

Fueling Innovation and Creativity

Virtual environments serve as laboratories for creative experimentation. Developers collaborate with artists and storytellers to build engaging worlds that push technological boundaries. This synergy results in groundbreaking approaches to entertainment, social interaction, and professional collaboration.

Beyond leisure applications, these technologies are revolutionizing fields like medical training, architectural visualization, and psychological therapy. The ability to simulate complex scenarios in safe, controlled environments offers transformative potential for numerous professions.

Challenges and Considerations

Despite the opportunities, significant hurdles remain. Intellectual property disputes, cybersecurity threats, and ethical questions about digital ownership require careful policy development. Establishing comprehensive governance frameworks will be crucial for sustainable growth in this sector. Without proper safeguards, the potential for exploitation and inequality could undermine public trust.

Equitable access presents another critical challenge. As these technologies develop, ensuring they don't exacerbate existing social disparities will require intentional design choices and policy interventions. The long-term success of virtual economies depends on inclusive development strategies.

The Role of Decentralized Finance (DeFi) in Metaverse Transactions

Decentralized Finance: A Paradigm Shift in Finance

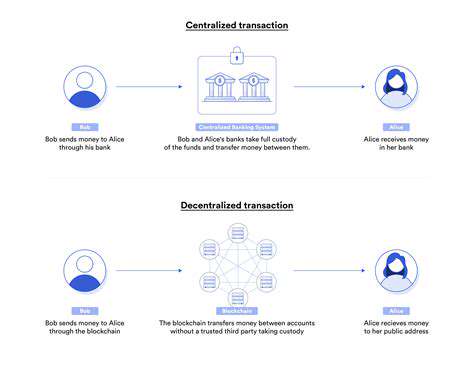

DeFi represents a fundamental reimagining of financial systems, eliminating traditional intermediaries through blockchain technology. This movement toward transparent, accessible finance responds to growing demand for systems that prioritize user control over institutional oversight. The development of trustless protocols enables financial services that operate without centralized authorities, creating new possibilities for global economic participation.

By building financial tools directly on distributed ledgers, DeFi circumvents the inefficiencies of conventional banking. This approach reduces transactional friction and could potentially lower costs for end-users. Decentralized exchanges exemplify this philosophy, enabling direct asset trading between parties without third-party involvement.

Key Components of Decentralized Finance

Smart contracts form the backbone of DeFi operations, automating complex financial agreements through immutable code. These programmable contracts enable diverse applications from automated lending to derivative trading. Decentralized exchanges complement this infrastructure by facilitating peer-to-peer asset transfers with enhanced privacy and control.

Additional pillars include algorithmic lending protocols, synthetic asset platforms, and liquidity mining systems. Together, these innovations demonstrate how blockchain technology can recreate traditional financial instruments with greater transparency and accessibility. The composability of DeFi protocols allows for continuous innovation as developers build upon existing infrastructure.

Challenges and Considerations

Security vulnerabilities present ongoing concerns, as high-profile exploits have demonstrated the risks of unaudited smart contracts. Comprehensive security practices must become standard to protect user assets. Network congestion also poses challenges, with some blockchains struggling to maintain performance during periods of high demand.

Regulatory clarity remains elusive as policymakers attempt to categorize these novel financial instruments within existing legal frameworks. Developing appropriate oversight without stifling innovation requires nuanced approaches that balance consumer protection with technological progress.

Looking Ahead: Challenges and Opportunities

Navigating the Complexities of the Metaverse Economy

The emerging metaverse economy combines tremendous potential with significant uncertainty. Cryptocurrency volatility introduces substantial risk for participants, as dramatic price swings can rapidly alter asset valuations. Market participants must develop robust risk management strategies to operate effectively in this environment.

Legal ambiguity surrounding digital property rights creates additional complexity. Without clear precedents for virtual land ownership or intellectual property protection, disputes may hinder ecosystem growth. Developing standardized legal frameworks will be essential for building confidence among institutional investors and mainstream users.

The Rise of NFTs and the Potential for Decentralization

NFTs have emerged as critical infrastructure for establishing verifiable digital ownership. By removing centralized gatekeepers, these tokens empower creators and collectors alike. This shift toward user-controlled assets could fundamentally alter how we conceptualize digital property rights and value creation.

The applications extend far beyond collectibles, enabling new models for content monetization and community engagement. As adoption grows, we'll likely see innovative uses in areas like event ticketing, professional certifications, and digital identity verification. However, technical limitations around scalability and environmental impact require continued attention from developers.

Integrating NFTs with DeFi protocols opens additional possibilities for financial innovation. Imagine collateralized loans using digital assets or fractional ownership of high-value virtual properties. Realizing this potential will require overcoming current limitations in blockchain throughput and transaction costs while maintaining robust security standards.

Sustained growth in the metaverse economy will depend on solving these technical challenges while fostering inclusive participation. The coming years will likely see continued experimentation as stakeholders work to balance innovation with stability in this rapidly evolving space.

Read more about The Economy of the Metaverse: NFTs, Virtual Goods, and More

Hot Recommendations

- Immersive Culinary Arts: Exploring Digital Flavors

- The Business of Fan Funded Projects in Entertainment

- Real Time AI Powered Dialogue Generation in Games

- Legal Challenges in User Generated Content Disclaimers

- Fan Fiction to Screenplays: User Driven Adaptation

- The Evolution of User Driven Media into Global Entertainment

- The Ethics of AI in Copyright Protection

- Building Immersive Narratives for Corporate Training

- The Impact of AI on Music Discovery Platforms

- AI for Audience Analytics and Personalized Content