The Investor's Guide to Immersive Entertainment

Understanding the Fundamentals

Investment opportunities, particularly in emerging sectors, often come with a significant amount of hype. This initial excitement can obscure the underlying fundamentals that are crucial for long-term success. A careful assessment must consider the market's intrinsic value, not just the current buzz. This involves evaluating the company's financial health, its competitive advantages, and the overall market trends. Ignoring these crucial factors can lead to poor investment decisions and potentially significant losses.

Thorough due diligence is essential to evaluate the true potential of an investment opportunity. This includes examining the company's historical performance, its management team's experience, and its projections for future growth. Analyzing the company's financial statements, including the balance sheet, income statement, and cash flow statement, is critical. These provide insights into the company's financial health, profitability, and ability to generate cash flow.

Identifying Market Trends

Staying informed about market trends is crucial for identifying promising investment opportunities. Monitoring relevant industry news, attending industry conferences, and engaging with industry experts can help investors gain a deeper understanding of emerging trends. This includes keeping abreast of technological advancements, evolving consumer preferences, and regulatory changes.

Market trends are not static; they are constantly evolving. A comprehensive analysis must consider the potential impact of these trends on the investment opportunity. This includes understanding how the investment will adapt to these changes and how these changes might impact its future profitability.

Evaluating Risk and Reward

A critical aspect of assessing investment opportunities is understanding the inherent risks and potential rewards. Every investment carries a degree of risk, and investors must carefully evaluate the potential downside before committing capital. This involves considering the current market conditions, the company's financial stability, and the overall economic climate.

The risk-reward ratio is a key metric. A high potential reward should not overshadow a high level of risk. A balanced approach that considers both the potential gains and the potential losses is essential for making informed investment decisions.

Analyzing Competitive Landscape

The competitive landscape plays a significant role in determining the viability of an investment opportunity. Understanding the strength and weaknesses of competitors is crucial for evaluating the investment's potential for success. An in-depth analysis of the competitive environment can provide valuable insights into the investment's market share, pricing strategies, and potential threats.

Assessing Management Team

The quality of the management team is often a crucial factor in determining the success of an investment. Evaluating the experience, expertise, and leadership qualities of the management team provides insights into the organization's ability to navigate challenges and capitalize on opportunities. A strong management team can significantly influence the company's performance and long-term success.

Exploring Exit Strategies

Developing a comprehensive understanding of potential exit strategies is essential for long-term investment success. This includes considering various scenarios, such as an acquisition by a larger company, an initial public offering (IPO), or a sale to a private equity firm. Anticipating potential exit strategies allows investors to align their investment horizon with the expected timeframe for realizing returns.

Considering Diversification

Diversification is a key principle of sound investment strategies. It involves spreading investments across different asset classes, industries, and geographies to mitigate risk. Diversification can help reduce the impact of potential losses in a specific investment or sector. A diversified portfolio is generally more resilient to market fluctuations.

Analyzing the Financial Projections and Market Dynamics

Understanding the Revenue Projections

A crucial aspect of any financial projection is the revenue forecast. This section delves into the methodologies used to predict future income, considering factors like market trends, sales strategies, and potential competition. Accurate revenue projections are essential for a realistic financial picture and guide critical investment decisions. Forecasting revenue requires careful consideration of historical data, market research, and anticipated growth rates.

Analyzing Cost Structures

Understanding the various cost components is paramount to evaluating the financial viability of the project. This involves examining variable costs, which fluctuate with production levels, and fixed costs, which remain constant regardless of output. Careful analysis of these cost structures is essential to identify potential cost-saving opportunities and optimize operational efficiency.

Assessing Profitability and Return on Investment (ROI)

A significant aspect of financial projections is the assessment of profitability and return on investment (ROI). Detailed calculations of net income, gross profit margins, and profitability ratios will provide a clear picture of the project's potential for generating returns. This analysis is vital for investors and stakeholders to evaluate the project's financial performance and potential for profitability.

Evaluating Funding Requirements

This section examines the financial resources needed to execute the project. It details the capital required for various stages, from initial setup to expansion. Detailed projections of funding needs will be essential for securing necessary investment or loans and ensuring sufficient funds to achieve project objectives. This includes outlining the required funding for operations, marketing, and expansion.

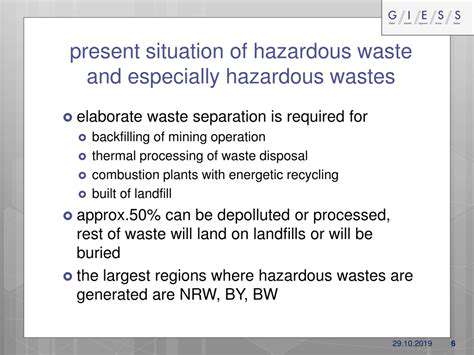

Risk Assessment and Mitigation Strategies

No financial projection is complete without addressing potential risks. This section identifies and assesses various risks, including market fluctuations, economic downturns, and competition. These risks are thoroughly analyzed, and mitigation strategies are proposed to minimize the negative impact of unforeseen circumstances. Understanding and planning for potential risks is crucial for ensuring a robust and adaptable financial plan. Developing contingency plans is a key element in risk mitigation.

Cash Flow Management

Effective cash flow management is vital for the financial health of any project. This section analyzes the expected cash inflows and outflows throughout the projected period. Detailed cash flow projections, including operating expenses, capital expenditures, and debt repayments, provide a clear picture of the project's liquidity position. Accurate cash flow forecasting is essential for ensuring the project's ability to meet its financial obligations and maintain stability. This assessment can also identify potential funding gaps and inform strategies to address them.

Read more about The Investor's Guide to Immersive Entertainment

Hot Recommendations

- Immersive Culinary Arts: Exploring Digital Flavors

- The Business of Fan Funded Projects in Entertainment

- Real Time AI Powered Dialogue Generation in Games

- Legal Challenges in User Generated Content Disclaimers

- Fan Fiction to Screenplays: User Driven Adaptation

- The Evolution of User Driven Media into Global Entertainment

- The Ethics of AI in Copyright Protection

- Building Immersive Narratives for Corporate Training

- The Impact of AI on Music Discovery Platforms

- AI for Audience Analytics and Personalized Content