Creative Economy of the Metaverse: New Income Streams

Virtual Goods: A Digital Marketplace

The rise of virtual goods, spanning from in-game collectibles to digital artwork, has reshaped online commerce, establishing a vibrant and ever-evolving marketplace. What fuels this growth? The craving for personalization, one-of-a-kind experiences, and lucrative investment opportunities. Today's digital enthusiasts actively trade and acquire these assets, cultivating a rich environment where virtual ownership thrives. Pricing fluctuates based on elements like scarcity, desirability, and artistic merit, mirroring traditional market dynamics.

Unlike physical commodities, virtual goods transcend borders, enabling worldwide participation. This global accessibility sparks innovation and teamwork, as users from different cultures exchange ideas and creations. However, this borderless nature also introduces complex questions regarding copyright protection and digital security measures.

Immersive Experiences: Beyond the Screen

Virtual and augmented reality technologies are redefining digital interaction, creating blended environments that merge physical and digital spaces. Users now enjoy unprecedented opportunities – exploring digital worlds, experiencing live performances remotely, and networking in virtual professional settings.

The applications extend far beyond leisure activities. Educational institutions and medical facilities are adopting these technologies for surgical simulations and architectural visualization, providing risk-free environments for skill development and creative exploration.

The Economics of Virtual Worlds

The financial landscape of digital assets presents fascinating developments. Novel economic systems are taking shape, characterized by digital currencies, in-world marketplaces, and asset trading platforms that challenge traditional commerce models. While still in their formative stages, these systems offer exciting prospects for creative business approaches.

Valuing virtual assets requires considering multiple variables. Community involvement, limited availability, and creative effort all influence an item's worth within digital ecosystems. This complexity presents both opportunities and challenges for financial experts and policymakers navigating this emerging sector.

The Social Impact of Virtual Spaces

Digital environments significantly influence social dynamics. Online communities built around shared interests provide connection opportunities that transcend physical limitations. For individuals facing geographical or social barriers, these spaces can offer meaningful engagement and acceptance.

Potential drawbacks include concerns about excessive screen time and identity issues. Promoting balanced technology use and healthy online interactions remains crucial as these platforms evolve.

Challenges and Opportunities in the Future

The digital asset sector faces both obstacles and prospects. Copyright protection, cybersecurity, and ethical dilemmas demand thoughtful consideration as the industry expands. Developing appropriate legal frameworks will be essential to address the unique challenges posed by these innovations.

Despite these hurdles, the creative potential remains enormous. Virtual environments could fundamentally transform learning methods, entertainment formats, and commercial transactions, introducing novel ways to interact and conduct business.

Gamified Economies and Play-to-Earn Models: Incentivizing Creative Participation

Understanding Gamified Economies

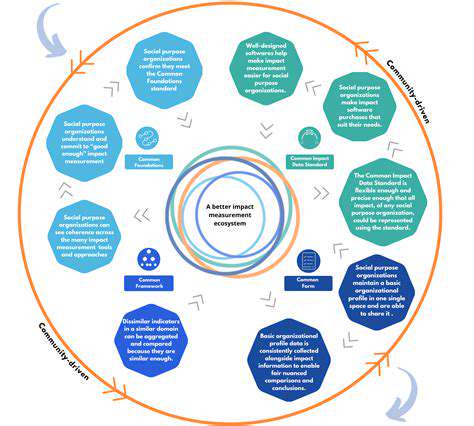

These innovative economic systems apply gaming principles to motivate participation in digital marketplaces. By creating virtual assets, currencies, and trading platforms within interactive environments, they attract participants who engage in various economic activities. The resulting ecosystems can achieve remarkable complexity, mirroring real-world financial systems while rewarding user engagement. The fundamental objective is establishing self-perpetuating digital economies where contributions receive appropriate recognition.

Successful implementations feature carefully designed reward structures. Incentives range from digital currencies to exclusive content access, with some systems even offering tangible rewards. The psychology behind motivation and satisfaction plays a critical role in crafting compelling engagement strategies.

The Concept of Play-to-Earn

This specialized model within gamified economies compensates participants for their involvement. Blockchain technology frequently supports these systems, providing secure verification of digital asset ownership and transactions. The ability to generate real economic value through gameplay introduces an innovative approach to digital entertainment and commerce.

Participants typically acquire, manage, and trade various virtual assets within these environments. From digital properties to rare collectibles, these items often appreciate in value, creating potential income streams for dedicated participants.

Key Features of Gamified Economies

Effective implementations incorporate compelling gameplay elements. Well-designed challenges, missions, and competitive features significantly enhance user experience and retention. The social dimension – enabling player interactions and transactions – contributes to vibrant community development and sustained engagement.

Challenges and Considerations

While promising, these systems face several implementation hurdles. Protecting against fraudulent activity becomes paramount when real economic value is involved. Potential issues like artificial inflation or market manipulation require ongoing attention. Additionally, regulatory compliance and legal implications must be addressed as these models gain mainstream traction.

The Future of Gamified Economies

The outlook for these innovative systems appears bright, with potential applications across multiple industries. The convergence of blockchain solutions and game mechanics continues to unlock new possibilities for both creators and participants. As technology advances, we can expect broader adoption in fields ranging from professional training to healthcare solutions, with real-world incentives driving increased participation.

Read more about Creative Economy of the Metaverse: New Income Streams

Hot Recommendations

- Immersive Culinary Arts: Exploring Digital Flavors

- The Business of Fan Funded Projects in Entertainment

- Real Time AI Powered Dialogue Generation in Games

- Legal Challenges in User Generated Content Disclaimers

- Fan Fiction to Screenplays: User Driven Adaptation

- The Evolution of User Driven Media into Global Entertainment

- The Ethics of AI in Copyright Protection

- Building Immersive Narratives for Corporate Training

- The Impact of AI on Music Discovery Platforms

- AI for Audience Analytics and Personalized Content