The Funding Landscape for Immersive Entertainment Scale ups

Understanding Market Validation

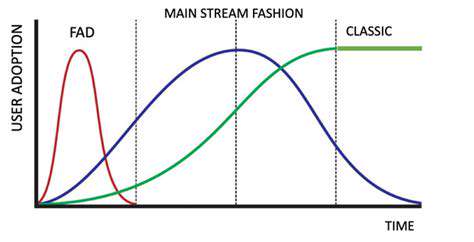

Market validation is the process of confirming that a product or service addresses a real need in the market. It's not just about identifying a problem; it's about demonstrating that there's a sufficient number of people willing to pay for a solution to that problem. This crucial step often involves surveys, interviews, and user testing, providing tangible data that investors require to assess the viability of a business model. A solid market validation process lays the groundwork for successful user acquisition and ultimately, secures funding.

Investors want to see evidence that the target market exists and that demand for the product or service is genuine. Thorough market validation demonstrates a clear understanding of the market and the problem being solved, thereby increasing the likelihood of securing funding.

Quantifying User Acquisition Costs (CAC)

User acquisition cost (CAC) is a key metric that demonstrates how much it costs to acquire a new user. Investors scrutinize CAC closely, seeking a sustainable and manageable cost structure for user growth. Understanding the different channels used for acquisition (social media, paid advertising, content marketing, etc.) and their associated costs is essential. A high CAC can signal unsustainable growth and potentially deter investors.

Analyzing CAC over time is critical. A decreasing CAC suggests an efficient and improving user acquisition strategy, while a rising one might indicate issues with marketing campaigns or targeting. Investors will analyze this trend to determine the long-term financial viability of the business.

Analyzing Customer Lifetime Value (CLTV)

Customer Lifetime Value (CLTV) represents the total revenue a business expects to generate from a single customer throughout their relationship. A high CLTV is a strong indicator of a successful business model, suggesting that customers are not only valuable in the short term, but also provide significant revenue over the long haul. Investors look for a positive relationship between CAC and CLTV, meaning that the cost of acquiring a customer is significantly outweighed by the revenue they generate.

A strong CLTV demonstrates the long-term financial sustainability of the venture. Investors want to see a clear path toward a sustainable and profitable business, and CLTV plays a critical role in demonstrating this to them.

Determining Churn Rate and Retention Strategies

Churn rate, the percentage of customers who stop using a product or service within a specific timeframe, is a critical metric that investors closely examine. A high churn rate can signal problems with the product, customer service, or the overall value proposition. Understanding the drivers of churn is crucial for developing effective retention strategies. Investors want to see evidence that the company is actively mitigating churn and building customer loyalty.

Effective customer retention strategies demonstrate a company's understanding of its customer base. Strategies should involve addressing customer feedback, improving the user experience, and delivering exceptional customer service. This demonstrates to potential investors a commitment to ongoing customer satisfaction and long-term value.

Tracking Key Performance Indicators (KPIs)

Investors require a clear understanding of the key performance indicators (KPIs) that are most relevant to the business. These KPIs vary depending on the industry and the specific product or service. Examples include website traffic, conversion rates, engagement metrics, and social media engagement. Consistent monitoring and reporting of these KPIs are essential to demonstrate progress and understanding of the market.

Investors want to see a clear understanding of the KPIs that matter most to the success of the venture and how these metrics are tracked and measured over time. This demonstrates a focus on measurable progress and a clear understanding of the business's performance.

Presenting Data in a Compelling Way

Ultimately, the most important aspect of market validation and user acquisition is presenting the data in a clear, concise, and compelling manner. Investors need to easily understand the key metrics, trends, and insights. Visualizations, clear summaries, and well-structured presentations are crucial to effectively communicate the value proposition to potential investors. This is where storytelling and clear communication of the business model and market position are essential.

A compelling presentation of data showcases a clear understanding of the business and its potential. Investors are looking for a well-structured narrative that clearly articulates the market opportunity, the company's unique position, and the potential for future growth. A polished presentation can significantly increase the likelihood of securing funding.

The Importance of Strategic Partnerships and M&A Activity

Strategic Partnerships: Expanding Reach and Resources

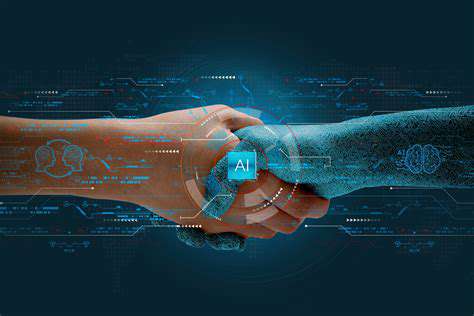

Strategic partnerships are crucial for businesses seeking to expand their market reach and access new resources. These alliances allow companies to leverage each other's strengths, potentially accelerating growth and innovation. A strong partnership can provide access to specialized expertise, new technologies, and expanded distribution channels. This collaborative approach often yields results faster and more efficiently than internal development, especially in rapidly evolving markets. For example, a software company might partner with a hardware manufacturer to integrate their products, creating a more compelling offering for end-users and bolstering market presence.

Beyond simply sharing resources, strategic partnerships can foster innovation by bringing together diverse perspectives and skill sets. The exchange of ideas and the combined knowledge base can lead to breakthroughs that neither partner could achieve independently. This dynamic synergy is vital in today's competitive landscape, where staying ahead of the curve requires constant adaptation and innovation.

Mergers and Acquisitions (M&A): Gaining Competitive Advantage

Mergers and acquisitions (M&A) are often a significant driver of growth and market consolidation. By acquiring complementary businesses, companies can rapidly expand their product portfolios, customer bases, and geographical reach. This approach can allow a company to quickly enter new markets or gain a significant foothold in existing ones. M&A activity can be a powerful tool for achieving economies of scale, reducing operational costs, and consolidating market share.

However, successful M&A integration is crucial for realizing the full potential of such transactions. Smooth integration involves careful planning, effective communication, and a strong commitment from leadership to ensure both organizational cultures are aligned. Failure to address these crucial elements can lead to significant challenges, including employee dissatisfaction and decreased productivity, ultimately hindering the desired outcomes.

Funding Opportunities for Partnerships and M&A

Securing funding for strategic partnerships and M&A activities is often a critical hurdle. Venture capital firms, private equity groups, and other investment vehicles play a key role in providing the necessary capital. Understanding the specific funding needs of each transaction and demonstrating a compelling return on investment (ROI) are essential for attracting investors. These investors are looking for well-defined strategies and a proven track record of success. A robust financial model that projects future growth and profitability is key to securing funding for significant M&A endeavors.

Synergies and Value Creation in Partnerships

A successful partnership or M&A transaction hinges on the creation of tangible synergies. These synergies can manifest in various ways, such as cost reductions, revenue enhancements, and accelerated innovation. Identifying and quantifying these potential benefits is essential for demonstrating the value proposition to investors and stakeholders. Understanding how the combined resources and expertise will create a greater output than the sum of its parts is critical to justifying the investment.

Successfully leveraging partnerships and M&A for growth requires a keen understanding of the target company's strengths and weaknesses, the current market dynamics, and the potential for future collaboration. A thorough due diligence process, coupled with a detailed integration plan, is necessary to maximize the value creation potential of these transactions.

Addressing Risks and Challenges in M&A and Partnerships

While partnerships and M&A offer significant potential, they also present inherent risks and challenges. Cultural integration issues, conflicts of interest, and potential legal complications can arise in both scenarios. Careful due diligence, thorough negotiation, and comprehensive planning are necessary to mitigate these risks and ensure a successful outcome. A clear understanding of the potential hurdles and proactive risk management strategies are vital for navigating the complexities of these transactions.

Effective communication and strong leadership are paramount in managing the potential for conflicts and disagreements among stakeholders. Ensuring transparency, building trust, and fostering a collaborative environment are crucial for navigating the challenges inherent in these complex transactions. Contingency planning and a robust crisis management framework can help mitigate unforeseen circumstances and safeguard the long-term success of the partnership or acquisition.

Read more about The Funding Landscape for Immersive Entertainment Scale ups

Hot Recommendations

- Immersive Culinary Arts: Exploring Digital Flavors

- The Business of Fan Funded Projects in Entertainment

- Real Time AI Powered Dialogue Generation in Games

- Legal Challenges in User Generated Content Disclaimers

- Fan Fiction to Screenplays: User Driven Adaptation

- The Evolution of User Driven Media into Global Entertainment

- The Ethics of AI in Copyright Protection

- Building Immersive Narratives for Corporate Training

- The Impact of AI on Music Discovery Platforms

- AI for Audience Analytics and Personalized Content