The Funding Rounds for Immersive Entertainment Companies

Series B Funding: Scaling Operations and Expanding Market Reach

When a company reaches Series B funding, it's at a pivotal moment in its growth trajectory. This stage isn't just about proving concepts anymore - it's about proving scalability. After successfully navigating Series A, businesses now focus on dramatically increasing their operational capacity and market presence. Teams grow substantially, product lines expand, and marketing efforts intensify to capture broader audiences. What investors really want to see? Demonstrated revenue traction and a realistic roadmap to profitability.

The transition from product development to market dominance requires careful strategy. Companies must build out robust sales infrastructure, forge strategic alliances, and sometimes establish new production facilities. Growth metrics become the new KPIs, with particular emphasis on customer acquisition costs and lifetime value. Differentiation from competitors becomes paramount - investors want to see how your immersive experience stands out in an increasingly crowded field. The capital injection here fuels not just expansion, but innovation, allowing for R&D investments that can redefine user experiences.

Series C Funding: Entering the Next Phase of Growth and Innovation

By Series C, companies are playing in the big leagues. This is where industry leaders emerge and market positions solidify. Successful Series B graduates now eye international expansion, major product innovations, or strategic acquisitions. What sets these companies apart? A proven growth trajectory, loyal customer bases, and razor-sharp market understanding. They're not just participants anymore - they're shaping the immersive experience landscape.

Securing Series C funding demands airtight financials and visionary planning. Investors scrutinize every projection, looking for sustainable growth models that balance expansion with profitability. The management team's ability to execute complex scaling becomes a make-or-break factor. This funding enables technological leaps - think AI integration, cutting-edge R&D, and exploring entirely new market verticals within immersive tech.

The stakes heighten dramatically at this stage. Operational complexity multiplies while maintaining product excellence becomes increasingly challenging. Companies must demonstrate not just current success, but foresight - how will they adapt to future market shifts? Leadership vision undergoes intense examination as investors bet on who will dominate the next wave of immersive experiences.

Factors Influencing Funding Decisions

Market Trends and Consumer Demand

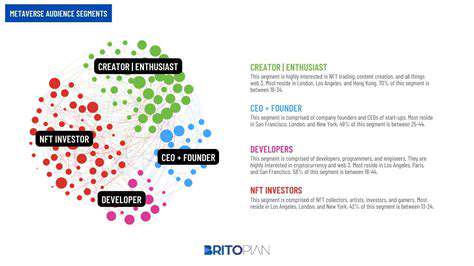

Savvy investors don't just follow trends - they anticipate seismic shifts in immersive entertainment. The most sought-after ventures demonstrate an uncanny ability to ride waves before they crest. It's not just about current VR/AR adoption rates, but predicting how haptic feedback or neural interfaces might revolutionize experiences. Deep consumer insights - from demographic preferences to price sensitivity - separate the winners from the also-rans.

The analysis goes deeper than surface-level metrics. True market leaders engineer virality into their DNA, creating experiences so compelling they generate organic growth through community building and user-generated content. This network effect becomes the ultimate moat against competitors.

Technological Innovation and Development

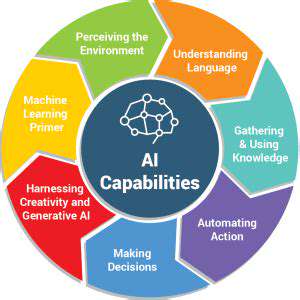

In immersive tech, standing still means falling behind. Investors hunt for companies pushing boundaries not just in hardware, but in creating seamless, intuitive experiences. The magic happens where cutting-edge rendering meets effortless UI/UX. But true visionaries look further - they're already prototyping with tech that won't hit mainstream for years.

The most compelling roadmaps don't just adopt emerging technologies - they redefine how they're used. AI isn't just a feature - it's the backbone of dynamic, personalized experiences. Cloud computing isn't infrastructure - it's the gateway to persistent, shared worlds. This forward-thinking approach separates temporary successes from enduring industry leaders.

Financial Projections and Business Model

Numbers tell the real story - but only if they're rooted in reality. Investors dissect financial models with forensic precision, searching for sustainable unit economics amidst the growth projections. The most convincing plans demonstrate deep understanding of acquisition costs, churn rates, and operational scaling.

But the best models do more than crunch numbers - they showcase adaptability. How will pricing evolve as markets mature? What secondary revenue streams might emerge? The businesses that attract premium valuations bake flexibility into their DNA, ready to pivot as technologies and consumer behaviors evolve.

Read more about The Funding Rounds for Immersive Entertainment Companies

Hot Recommendations

- Immersive Culinary Arts: Exploring Digital Flavors

- The Business of Fan Funded Projects in Entertainment

- Real Time AI Powered Dialogue Generation in Games

- Legal Challenges in User Generated Content Disclaimers

- Fan Fiction to Screenplays: User Driven Adaptation

- The Evolution of User Driven Media into Global Entertainment

- The Ethics of AI in Copyright Protection

- Building Immersive Narratives for Corporate Training

- The Impact of AI on Music Discovery Platforms

- AI for Audience Analytics and Personalized Content